CATA’s First Webinar on E-Invoicing: Models of Implementation and Lessons Learned

- Jun 6, 2025

- 1 min read

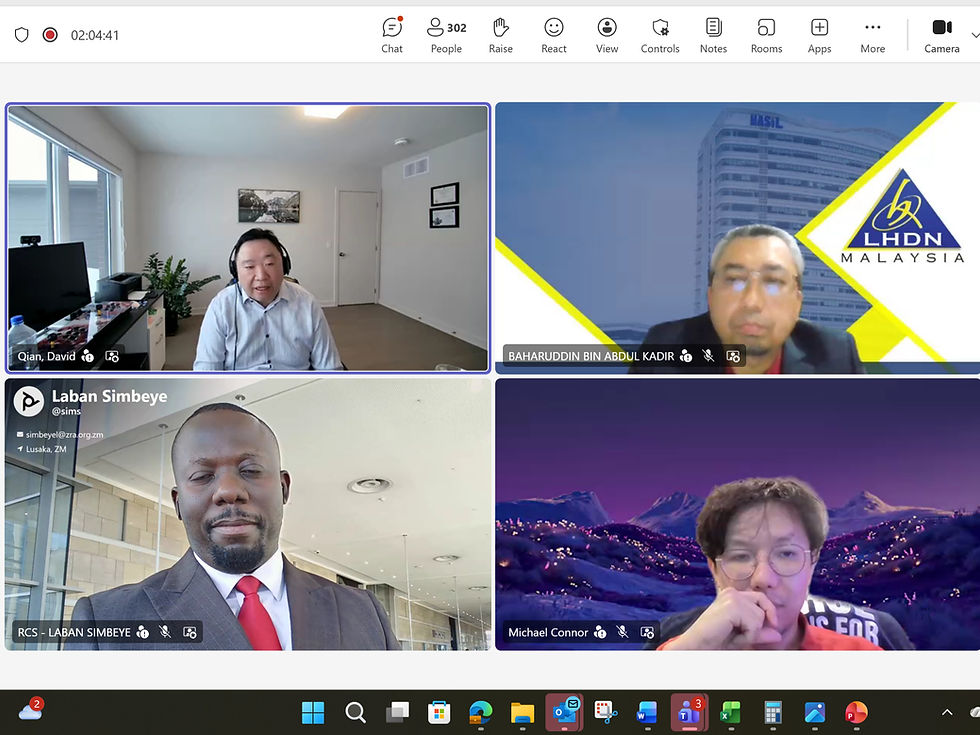

On 5th June 2025, the Commonwealth Association of Tax Administrators (CATA) successfully launched the first in a series of webinars focused on E-Invoicing. The inaugural session, titled "Models of Implementation and Lessons Learned," was delivered by esteemed colleagues from the Inter-American Center of Tax Administrations (CIAT) and attracted a global audience of tax professionals.

The webinar aimed to provide a comprehensive understanding of the various models for adopting electronic invoicing and to share valuable insights from previous implementation experiences. The session was meticulously designed to help tax administrations determine the most suitable E-Invoicing model for their needs, while also highlighting best practices and common pitfalls to avoid .

The event commenced with an introduction by Leo Ferre, Chair of the CATA E-Invoicing Working Group, who set the stage for the discussions to follow. Vinícius Pimentel de Freitas from CIAT then presented on the different models for the adoption of electronic invoicing, providing a detailed analysis of their characteristics and benefits. This was followed by a joint presentation by Vinícius and Raul Zambrano at CIAT, who shared lessons learned from implementing national electronic invoicing programs.

A lively Q&A session moderated by Vinícius and Raul welcomed participants to engage directly with the speakers, fostering an interactive and informative dialogue. The webinar concluded with a summary and closing remarks by Dr. Esther A. P. Koisin, Executive Director of CATA, who emphasised the importance of peer learning and collaboration among tax administrations worldwide.

The positive reception and high attendance of this first session underscore the value of such initiatives in fostering international cooperation and knowledge sharing.