Lesotho Showcases e-Invoicing Journey in CATA Experience-Sharing Webinar

- Sep 19, 2025

- 2 min read

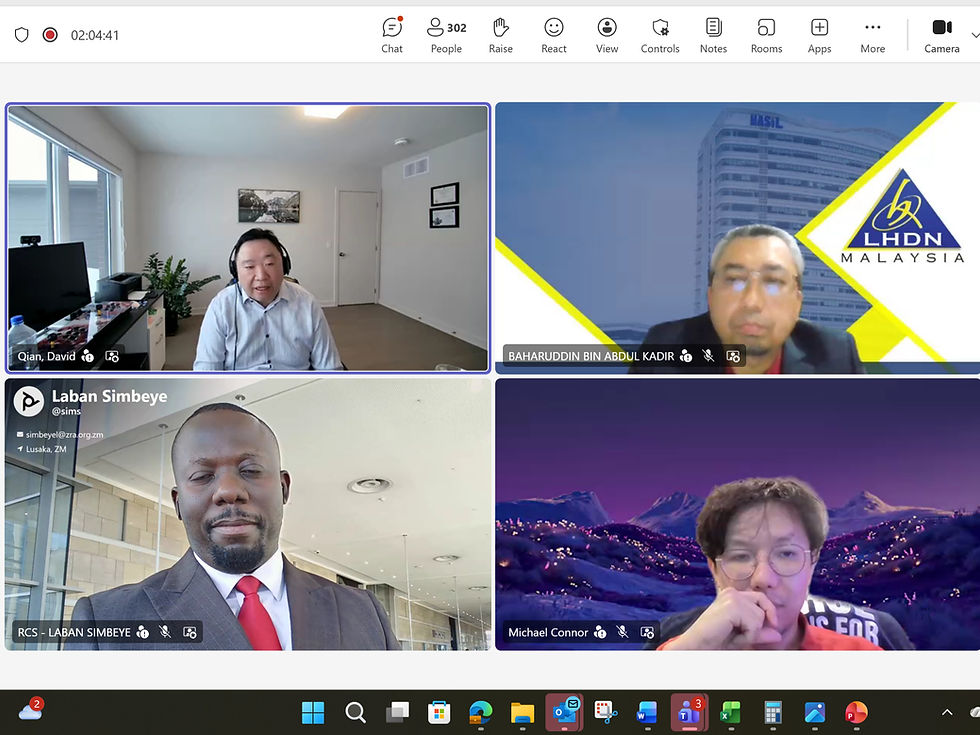

The Revenue Services Lesotho (RSL), in collaboration with the Commonwealth Association of Tax Administrators (CATA), hosted a highly informative virtual session titled “E-Invoicing Case Study: Lesotho” on 18 September 2025. The webinar brought together CATA members and stakeholders to explore Lesotho’s e-Invoicing journey — locally known as Lekuka — from concept to implementation.

The session was formally opened by Mr Amal Lolljee of the Mauritius Revenue Authority (MRA), speaking on behalf of CATA, as MRA currently holds the Chair of the E-Invoicing Working Group. Mr. Lolljee welcomed participants, outlined the session’s objectives, introduced the speakers, and officially opened the floor to the Lesotho team.

The event featured presentations by senior LRA officials and technical experts. Mr Rakokoana Makoa, Commissioner of Client Services and Chair of the Digitalisation Programme Steering Committee, began with an overview of why e-Invoicing matters, its results-based logical framework, and the foundational elements of the Lekuka system.

Mrs Puseletso Ntene, Head of the Delivery Unit, gave a detailed presentation on the e-Invoicing architecture, including system components, operational models, and how e-Invoicing integrates within Revenue Services Lesotho (RSL).

Mr Thabo Magaga, Project Manager, shared progress updates on the development of Minimum Viable Products (MVPs), change management strategies, and current status of implementation. Mr Tlali Phoofolo concluded the technical discussion with key reflections on challenges, mitigations, and future considerations.

The session also included expert insights from Mr Michailas Traubas of NRD Companies, who provided a supplier’s perspective and technical guidance based on their international experience supporting e-Invoicing solutions.

It was a great opportunity to hear from members about what is happening as sharing best practise is a tool that can help us all.

CATA extends its sincere thanks to the RSL team for their openness, professionalism, and leadership in showcasing digital tax reform in action. Special thanks also go to MRA for their ongoing support and to all participants who contributed to this valuable peer-learning exchange. The session reaffirmed CATA’s commitment to promoting innovation, collaboration, and shared learning among its member administrations.